If you use tax filing software like TurboTax to prepare your tax return, the software will automatically enter your income on the correct lines.If you're an employee, the wages from your W-2 go on line 1 of Form 1040, and the federal income taxes your employer withheld go on line 25.Whether you're an independent contractor or an employee, you'll use Form 1040 to file your tax return as a delivery driver. If you're not sure whether you're an employee or a contract worker, talk to your employer. At the end of the year, they should receive a Form 1099-NEC showing total earnings for the year.

The companies that hire them don't usually withhold income or payroll taxes from their payments.

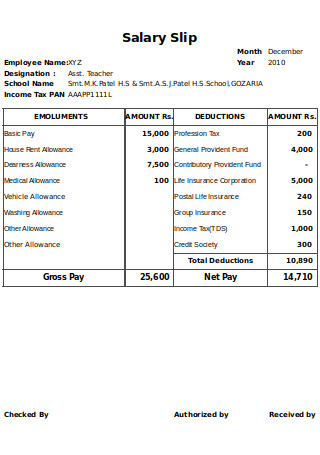

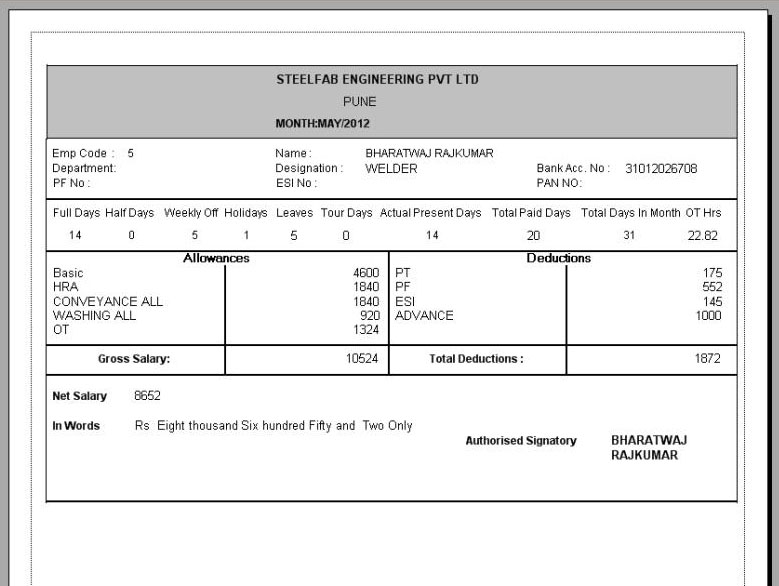

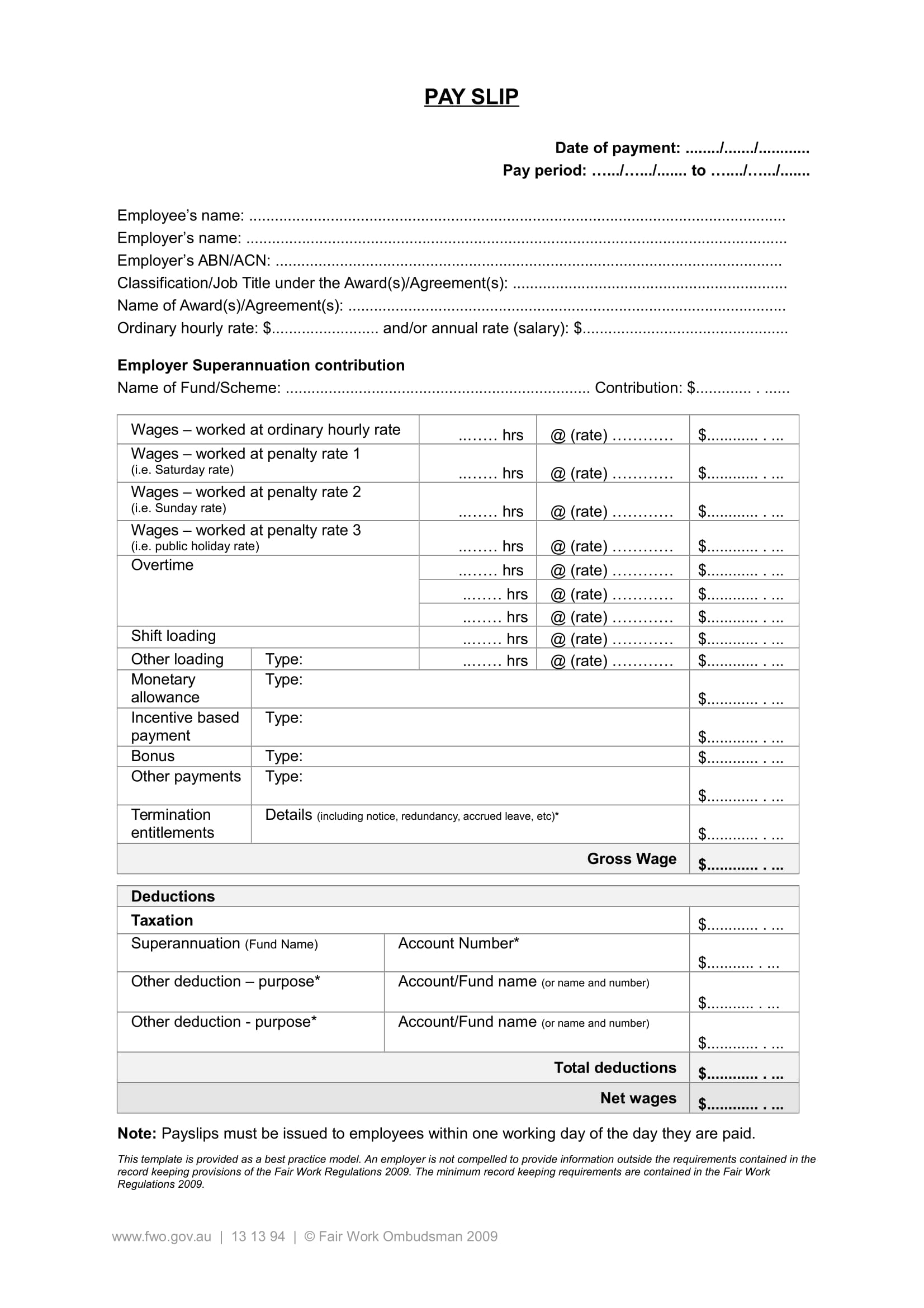

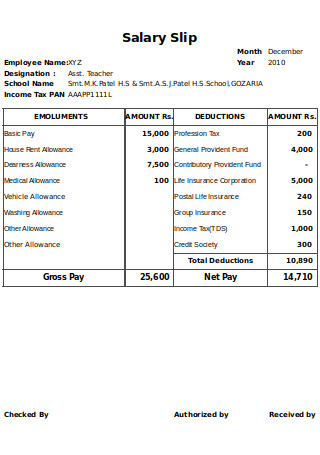

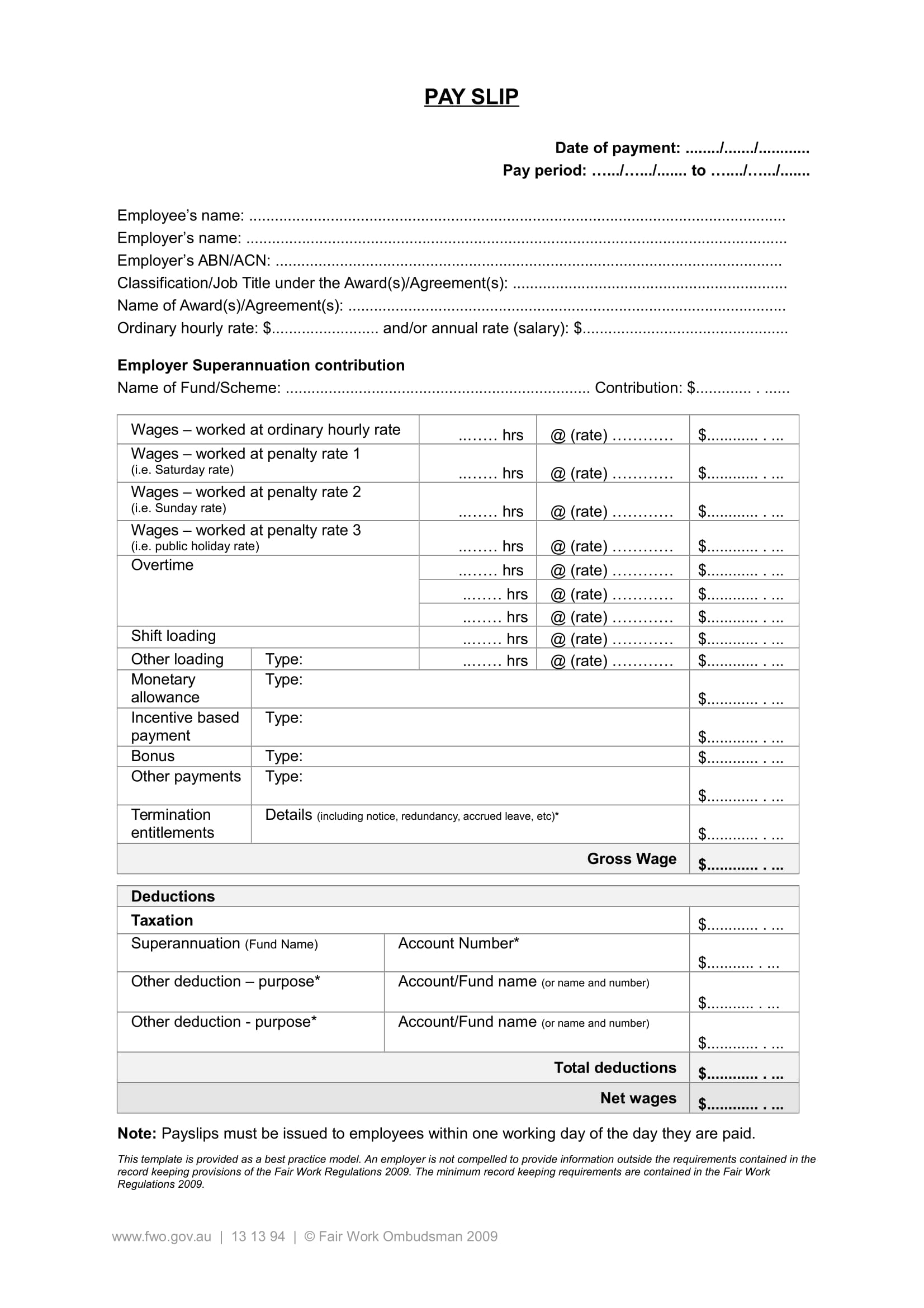

Independent contractors are typically considered self-employed. At year-end, they typically receive a Form W-2 showing the income they earned for the year and total tax withheld. Employees generally receive regular paychecks usually with income, Social Security and Medicare taxes withheld from their wages. How you report your income and whether you can deduct expenses depends on whether you're an employee or an independent contractor. Here's what you should know about filing tax returns for delivery drivers. Whether you work for companies like Amazon, UPS or a new app-based platform, being a delivery driver means understanding key facts so you can file your taxes accurately and on-time. With the growth in the on-demand economy, being a delivery driver can be a great way to make money, either full time or as a side gig. Typically, these deductions are not available if you’re an employee. These write-offs may include mileage, tolls, mobile phone charges, supplies, and more. If you’re an independent contractor, you can typically deduct work-related expenses on Schedule C. You should receive a 1099-NEC from each company you deliver for. As an independent contractor, you should receive a Form 1099-NEC showing your total earnings for the year.

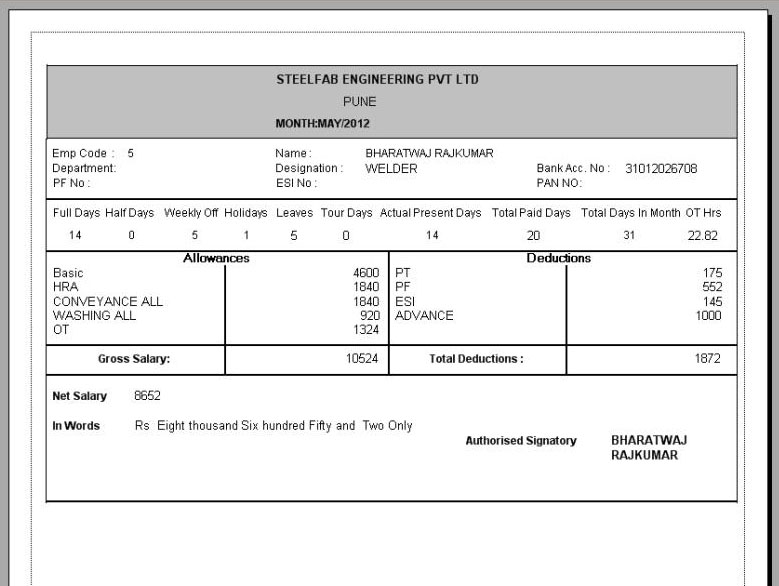

If you’re an independent contractor, you’re responsible for paying both the employer and employee portions of your Social Security and Medicare taxes, also known as self-employment taxes.At the end of the year, you’ll receive a Form W-2 showing the income you earned for the year and total tax withheld. If you’re an employee of Amazon, UPS, or another company, your Social Security, Medicare, and possibly federal and state income taxes will be withheld from your paycheck.

0 kommentar(er)

0 kommentar(er)